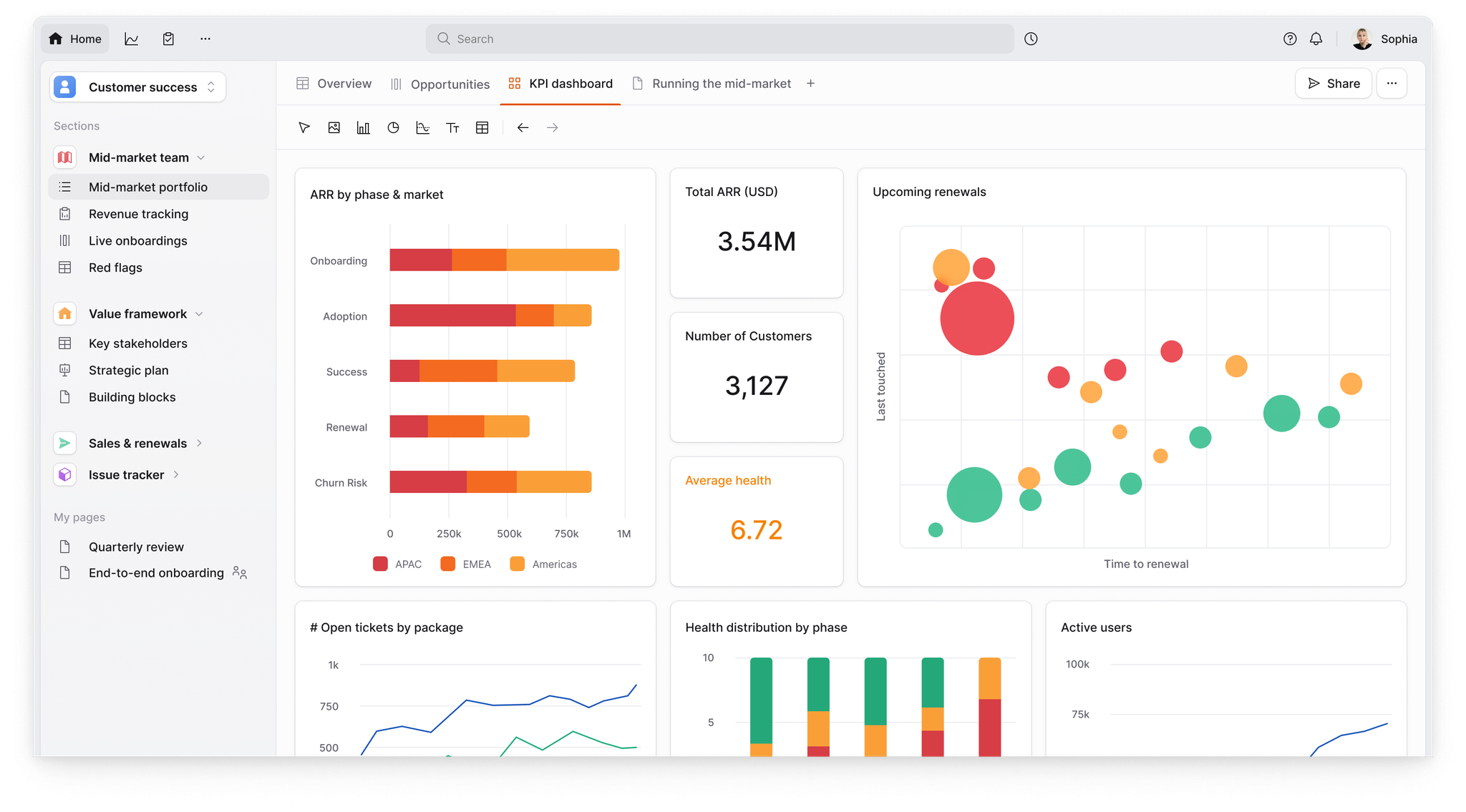

Customer Success Software

Retain and grow customer revenue

Achieve sustained growth by converting customer data into actions that deliver more value, to more customers, faster.

Customer Success Software

Retain and grow customer revenue

Achieve sustained growth by converting customer data into actions that deliver more value, to more customers, faster.

Customer Success Software

Retain and grow customer revenue

Achieve sustained growth by converting customer data into actions that deliver more value, to more customers, faster.

Customer Success Software

Retain and grow customer revenue

Achieve sustained growth by converting customer data into actions that deliver more value, to more customers, faster.

Kill churn,

deliver success.

Kill churn,

deliver success.

Kill churn,

deliver success.

Kill churn,

deliver success.

“It doesn't matter what the ACV is, it doesn't matter how large the account is: they're going to be guaranteed a successful path.”

Brandon Ramsey

Vice President of Customer Success

“It doesn't matter what the ACV is, it doesn't matter how large the account is: they're going to be guaranteed a successful path.”

Brandon Ramsey

Vice President of Customer Success

“It doesn't matter what the ACV is, it doesn't matter how large the account is: they're going to be guaranteed a successful path.”

Brandon Ramsey

Vice President of Customer Success

“It doesn't matter what the ACV is, it doesn't matter how large the account is: they're going to be guaranteed a successful path.”

Brandon Ramsey

Vice President of Customer Success

“Planhat’s automations have enabled us to offload a significant portion of our repetitive manual tasks to bespoke, data-driven workflows running in the background: allowing our teams to stay focused on managing customers, not admin.”

Alexey Smolyanyy

Director, Customer Success

“Planhat’s automations have enabled us to offload a significant portion of our repetitive manual tasks to bespoke, data-driven workflows running in the background: allowing our teams to stay focused on managing customers, not admin.”

Alexey Smolyanyy

Director, Customer Success

“Planhat’s automations have enabled us to offload a significant portion of our repetitive manual tasks to bespoke, data-driven workflows running in the background: allowing our teams to stay focused on managing customers, not admin.”

Alexey Smolyanyy

Director, Customer Success

“Planhat’s automations have enabled us to offload a significant portion of our repetitive manual tasks to bespoke, data-driven workflows running in the background: allowing our teams to stay focused on managing customers, not admin.”

Alexey Smolyanyy

Director, Customer Success

Deliver customer outcomes

Understand customer needs at a glance and deliver outcomes consistently and collaboratively. Establish and iterate constantly on best practices that empower you to deliver customer value in the right way, at the right time.

Deliver customer outcomes

Understand customer needs at a glance and deliver outcomes consistently and collaboratively. Establish and iterate constantly on best practices that empower you to deliver customer value in the right way, at the right time.

Deliver customer outcomes

Understand customer needs at a glance and deliver outcomes consistently and collaboratively. Establish and iterate constantly on best practices that empower you to deliver customer value in the right way, at the right time.

Deliver customer outcomes

Understand customer needs at a glance and deliver outcomes consistently and collaboratively. Establish and iterate constantly on best practices that empower you to deliver customer value in the right way, at the right time.

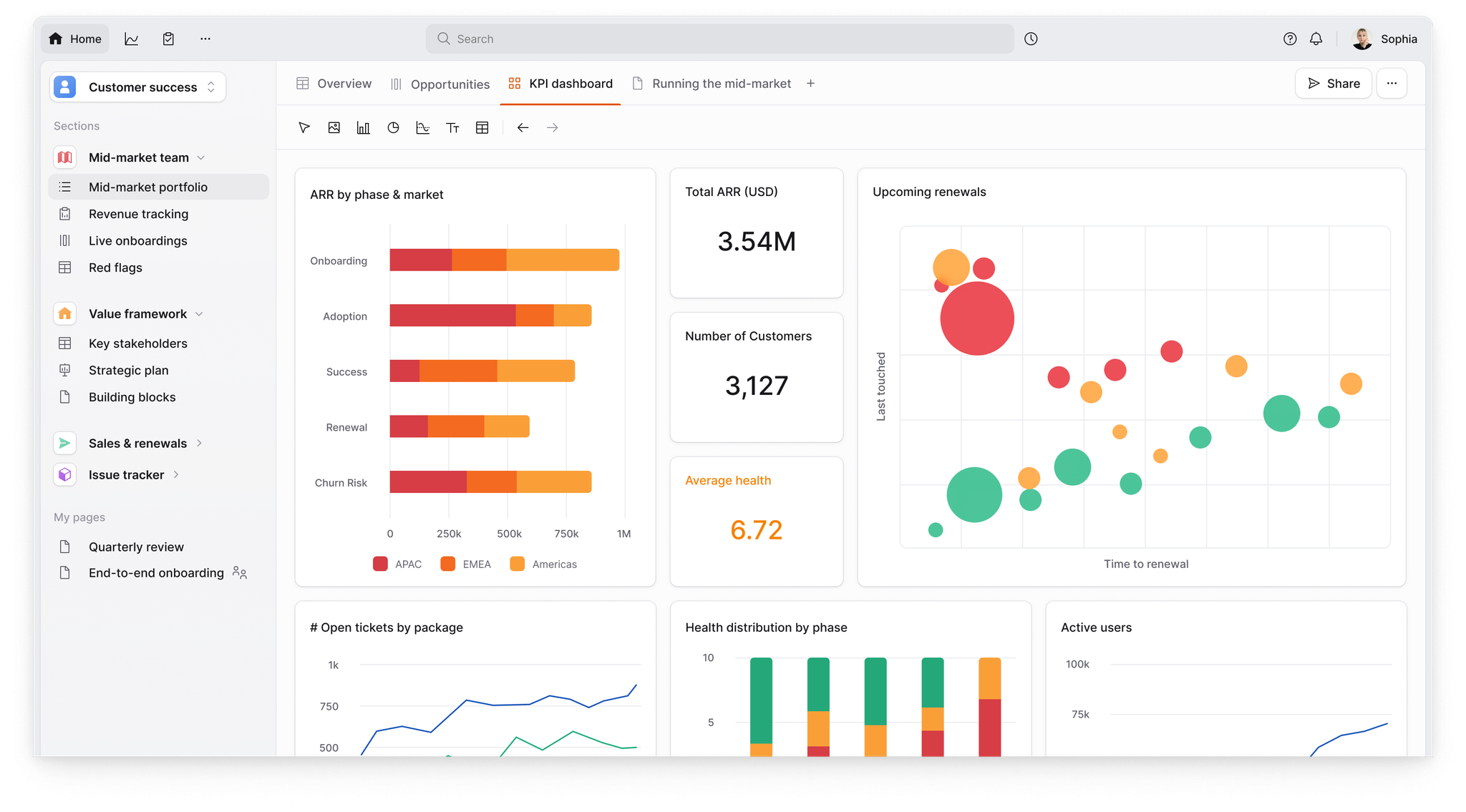

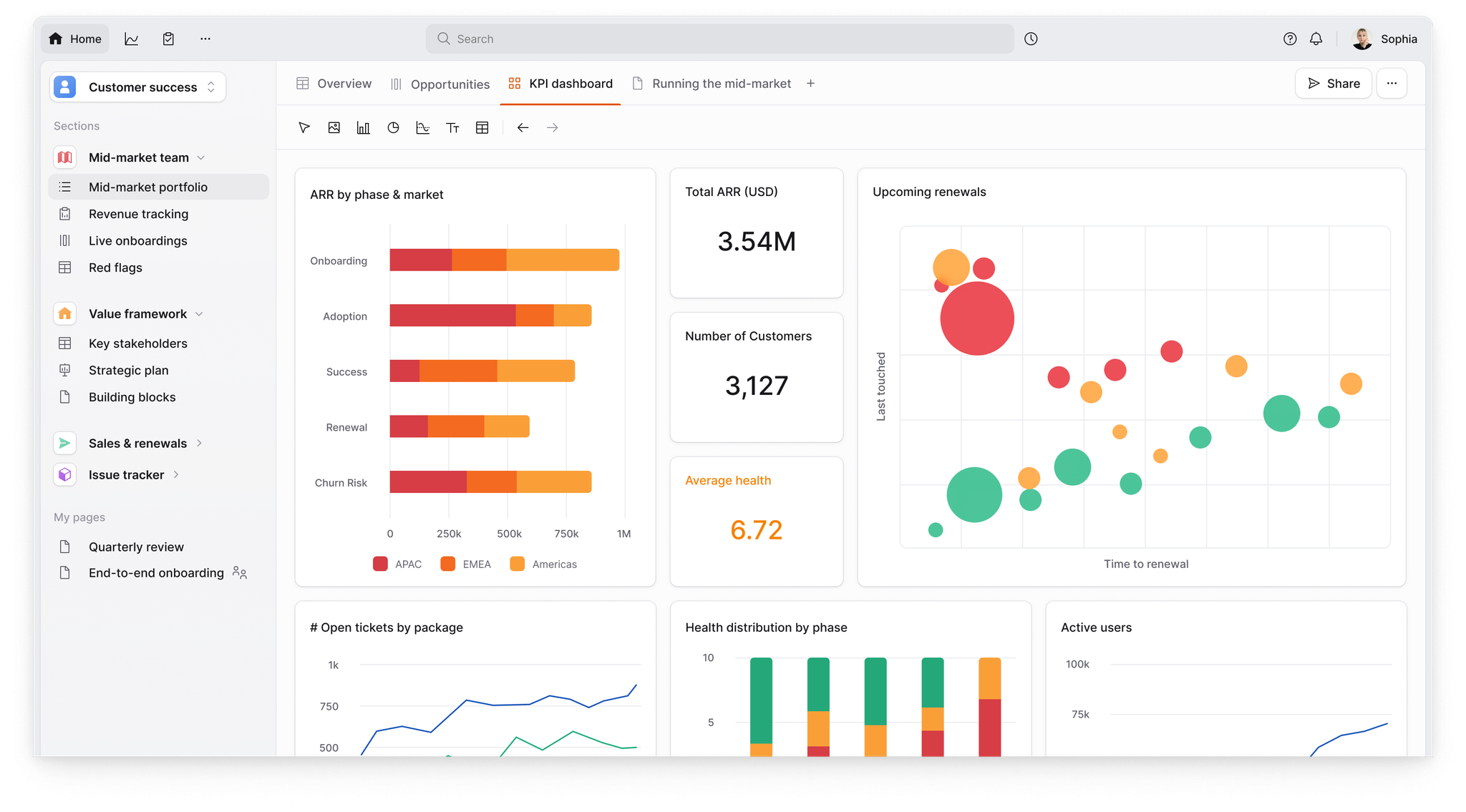

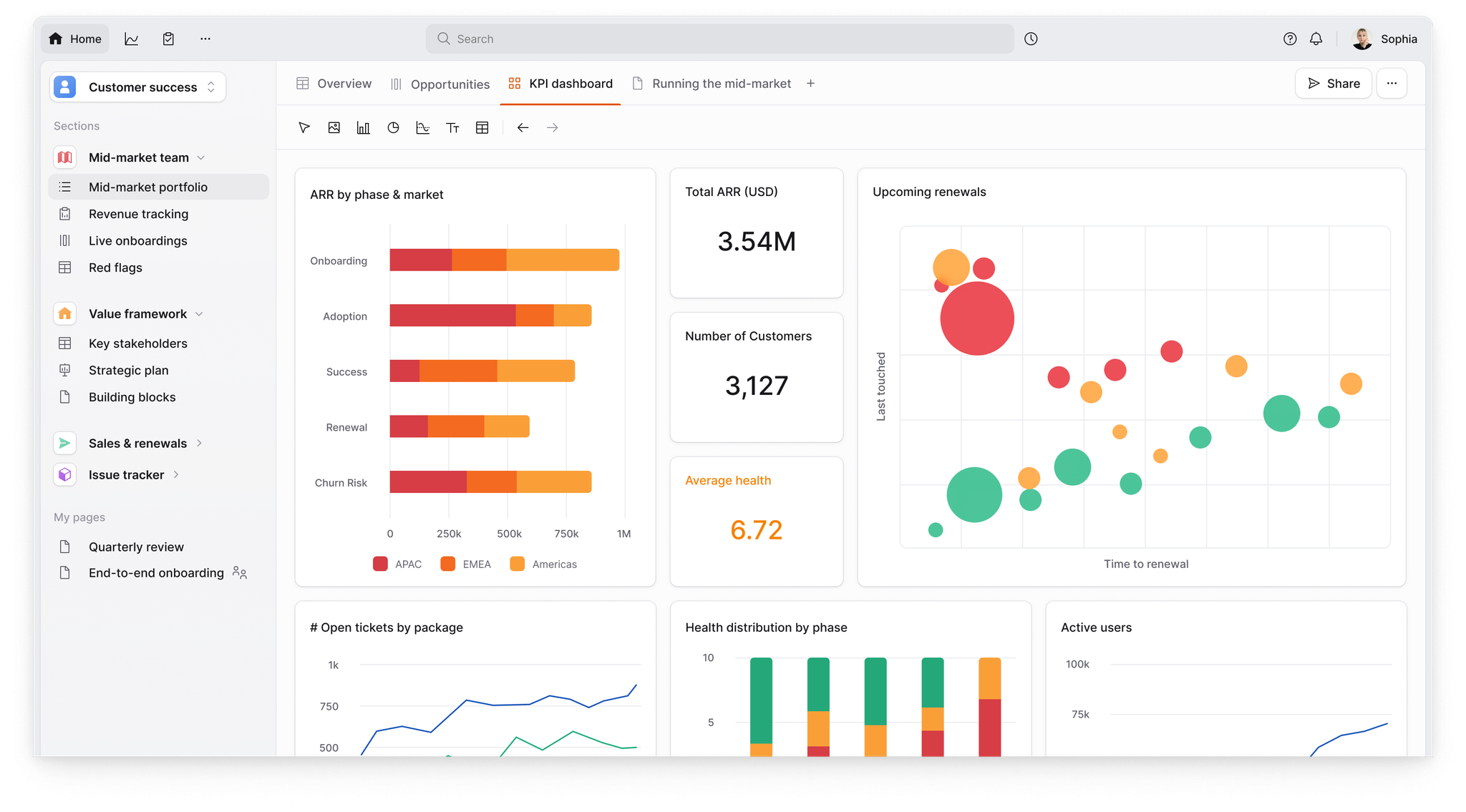

Measure ROI

Know exactly what works and what doesn't to ensure you're constantly spending time on the things that convert to the most value. Maximize the resources you have to serve more customers, more successfully, without growing your team.

Measure ROI

Know exactly what works and what doesn't to ensure you're constantly spending time on the things that convert to the most value. Maximize the resources you have to serve more customers, more successfully, without growing your team.

Measure ROI

Know exactly what works and what doesn't to ensure you're constantly spending time on the things that convert to the most value. Maximize the resources you have to serve more customers, more successfully, without growing your team.

Measure ROI

Know exactly what works and what doesn't to ensure you're constantly spending time on the things that convert to the most value. Maximize the resources you have to serve more customers, more successfully, without growing your team.

Powered by AI

Planhat is powered by AI. Work smarter, not harder, with native writing assistance, one-click account and conversation summaries, and the freedom to embed custom LLMs through no-code automation flows.

Powered by AI

Planhat is powered by AI. Work smarter, not harder, with native writing assistance, one-click account and conversation summaries, and the freedom to embed custom LLMs through no-code automation flows.

Powered by AI

Planhat is powered by AI. Work smarter, not harder, with native writing assistance, one-click account and conversation summaries, and the freedom to embed custom LLMs through no-code automation flows.

Powered by AI

Planhat is powered by AI. Work smarter, not harder, with native writing assistance, one-click account and conversation summaries, and the freedom to embed custom LLMs through no-code automation flows.

“Just during our first month of using the platform we saved more than 100 hours by automating pricing notification, winback, CSM change and campaign emails.”

Lasse Thomsen

Head of Commercial Operations

“Just during our first month of using the platform we saved more than 100 hours by automating pricing notification, winback, CSM change and campaign emails.”

Lasse Thomsen

Head of Commercial Operations

“Just during our first month of using the platform we saved more than 100 hours by automating pricing notification, winback, CSM change and campaign emails.”

Lasse Thomsen

Head of Commercial Operations

“Just during our first month of using the platform we saved more than 100 hours by automating pricing notification, winback, CSM change and campaign emails.”

Lasse Thomsen

Head of Commercial Operations

Deliver value faster

Find out what your customer needs most and how to deliver it. Cut time to value with tried-and-tested workflows and resources delivered at scale.

Deliver value faster

Find out what your customer needs most and how to deliver it. Cut time to value with tried-and-tested workflows and resources delivered at scale.

Deliver value faster

Find out what your customer needs most and how to deliver it. Cut time to value with tried-and-tested workflows and resources delivered at scale.

Deliver value faster

Find out what your customer needs most and how to deliver it. Cut time to value with tried-and-tested workflows and resources delivered at scale.

“Our license upsells are 24% higher this year than last year. Now we can see when customers are approaching their license limit and speak to them proactively, all thanks to the visibility we get on our customers with Planhat.”

Ryan O'Connell

Chief Operating Officer

“Our license upsells are 24% higher this year than last year. Now we can see when customers are approaching their license limit and speak to them proactively, all thanks to the visibility we get on our customers with Planhat.”

Ryan O'Connell

Chief Operating Officer

“Our license upsells are 24% higher this year than last year. Now we can see when customers are approaching their license limit and speak to them proactively, all thanks to the visibility we get on our customers with Planhat.”

Ryan O'Connell

Chief Operating Officer

“Our license upsells are 24% higher this year than last year. Now we can see when customers are approaching their license limit and speak to them proactively, all thanks to the visibility we get on our customers with Planhat.”

Ryan O'Connell

Chief Operating Officer

Create delightful experiences

Make every customer feel like your only customer, no matter whether you're low-touch, high-touch or pooled. Drive value collaboratively.

Create delightful experiences

Make every customer feel like your only customer, no matter whether you're low-touch, high-touch or pooled. Drive value collaboratively.

Create delightful experiences

Make every customer feel like your only customer, no matter whether you're low-touch, high-touch or pooled. Drive value collaboratively.

Create delightful experiences

Make every customer feel like your only customer, no matter whether you're low-touch, high-touch or pooled. Drive value collaboratively.

“The open rate on those emails, because they're coming from the CSM, is 38% - whereas a typical marketing email would have a 1-2% open rate. "

Tracy Shouldice

Director of Customer Success

“The open rate on those emails, because they're coming from the CSM, is 38% - whereas a typical marketing email would have a 1-2% open rate. "

Tracy Shouldice

Director of Customer Success

“The open rate on those emails, because they're coming from the CSM, is 38% - whereas a typical marketing email would have a 1-2% open rate. "

Tracy Shouldice

Director of Customer Success

“The email open rate, because they're coming from the CSM, is 38% - whereas a typical marketing email would have a 1-2% open rate. "

Tracy Shouldice

Director of Customer Success

“We use Planhat to deeply analyze customer behavior, identify trends and understand customer satisfaction - all to find opportunities for improvement in the way we manage our customers.”

Urban Jansson

Head of Customer Experience

“We use Planhat to deeply analyze customer behavior, identify trends and understand customer satisfaction - all to find opportunities for improvement in the way we manage our customers.”

Urban Jansson

Head of Customer Experience

“We use Planhat to deeply analyze customer behavior, identify trends and understand customer satisfaction - all to find opportunities for improvement in the way we manage our customers.”

Urban Jansson

Head of Customer Experience

“We use Planhat to deeply analyze customer behavior, identify trends and understand customer satisfaction - all to find opportunities for improvement in the way we manage our customers.”

Urban Jansson

Head of Customer Experience

Achieve more with less

Deliver more value to more customers, without scaling your team. Deploy AI and automation to delegate admin and double-down on high-ROI activities.

Achieve more with less

Deliver more value to more customers, without scaling your team. Deploy AI and automation to delegate admin and double-down on high-ROI activities.

Achieve more with less

Deliver more value to more customers, without scaling your team. Deploy AI and automation to delegate admin and double-down on high-ROI activities.

Achieve more with less

Deliver more value to more customers, without scaling your team. Deploy AI and automation to delegate admin and double-down on high-ROI activities.

“Since we implemented Planhat, our onboarding efficiency has improved by roughly 200% as we have progressed from onboarding 7-10 customers to successfully onboarding 20+ per CSM.”

Martina Holma

Vice President, Customer Success

“Since we implemented Planhat, our onboarding efficiency has improved by roughly 200% as we have progressed from onboarding 7-10 customers to successfully onboarding 20+ per CSM.”

Martina Holma

Vice President, Customer Success

“Since we implemented Planhat, our onboarding efficiency has improved by roughly 200% as we have progressed from onboarding 7-10 customers to successfully onboarding 20+ per CSM.”

Martina Holma

Vice President, Customer Success

“Since we implemented Planhat, our onboarding efficiency has improved by roughly 200% as we have progressed from onboarding 7-10 customers to successfully onboarding 20+ per CSM.”

Martina Holma

Vice President, Customer Success

FAQ

What is customer success software?

Do I need to use Planhat as a CRM to get value from Planhat for Customer Success?

Do I need dedicated technical support to implement Planhat's software?

How is Planhat for Customer Success different to other CS solutions, like ChurnZero or Vitally?

How much time does it take to implement customer success software?

Unify your ecosystem

Your entire organization, built around your customer.

FAQ

What is customer success software?

Do I need to use Planhat as a CRM to get value from Planhat for Customer Success?

Do I need dedicated technical support to implement Planhat's software?

How is Planhat for Customer Success different to other CS solutions, like ChurnZero or Vitally?

How much time does it take to implement customer success software?

Unify your ecosystem

Your entire organization, built around your customer.

FAQ

What is customer success software?

Do I need to use Planhat as a CRM to get value from Planhat for Customer Success?

Do I need dedicated technical support to implement Planhat's software?

How is Planhat for Customer Success different to other CS solutions, like ChurnZero or Vitally?

How much time does it take to implement customer success software?

Unify your ecosystem

Your entire organization, built around your customer.

FAQ

What is customer success software?

Do I need to use Planhat as a CRM to get value from Planhat for Customer Success?

Do I need dedicated technical support to implement Planhat's software?

How is Planhat for Customer Success different to other CS solutions, like ChurnZero or Vitally?

How much time does it take to implement customer success software?

Unify your ecosystem

Your entire organization, built around your customer.

Resources

Customers

© 2025 Planhat AB

Resources

Customers

© 2025 Planhat AB

Resources

Customers

© 2025 Planhat AB

Resources

Customers

© 2025 Planhat AB